Past Paper 1 : Applied Accounting Guess Paper

University Name – Confidential

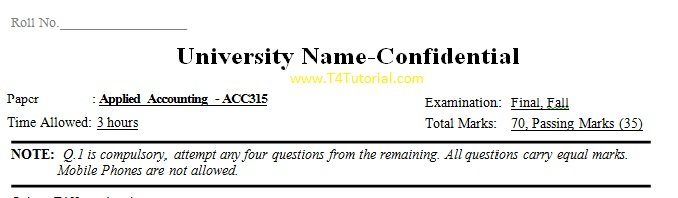

NOTE: Q.1 is compulsory, attempt any four questions from the remaining. All questions carry equal marks. Phones and other Electronic Gadgets are not allowed. Paper : Applied Accounting Time Allowed: 3 hours Examination: Final, Fall – 2020 Total Marks: 70, Passing Marks (35) Applied Accounting Universities Past Pasts

Q.1 Differentiate between;

Applied Accounting Universities Past Pasts

Q.1 Differentiate between;

- Accounting and Book keeping

- Ledger and Journal

- Liabilities and Owner’s equity

- Opening balance and ending balance

- Accounts Receivable and Notes Receivable

- Account payable and Notes payable

- Horizontal and vertical analysis.

- 2 What is ledger and why it is kept balanced by an Accountant in a Company?

- 4 Explain the purpose of a statement of cash flows with the help of relevant examples.

- 5 What is Depreciation? Discuss Straight line depreciation method and Reducing balance depreciation method in detail.

- Stock holders equity and retained earning .

- Forms of business organizations.

- Ratio Analysis.

Past Paper 2 : Applied Accounting Guess Paper

University Name – Confidential

Past Paper 3 : Applied Accounting Guess Paper

University Name – Confidential

NOTE: Q.1 is compulsory, attempt any four questions from the remaining. All questions carry equal marks. Phones and other Electronic Gadgets are not allowed. Paper : Applied Accounting Time Allowed: 3 hours Examination: Final, Fall – 2020 Total Marks: 70, Passing Marks (35) Q.1 Write short note on the following- Define accounting.

- Financial statements

- What is the abbreviation for accounting terms debit and credit.

- Explain the basic accounting equation.

- Name different branches of accounting.

- state the amount of depreciation expense per year and per month. Give the adjusting entry to record depreciation on the truck at the end of first month and explain where the accounts involved would appear in financial statements.

- assume the delivery truck was acquired on September 1, 2001, and that this vehicle is only delivery truck owned by the business. Show how this truck would be reported in Libra Pharmacy’s balance sheet at December 31, 2001.

- compare the amount credited to Accumulated Depreciation in the adjusting entry in part a to the accumulated depreciation reported in the balance sheet at December 31, 2001 (part b). are these two amounts the same? Explain briefly.

- March 19, drafted a trust agreement for Patrick Stewart. Sent stewart an invoice for $1200 requesting payment within 30 days. ( the appropriate revenue account is entitled legal fees earned.)

- May 15, Owner Jean, Rodenberry withdraws $6000 from the business for personal use.

- May 31, received a bill from lawyers Delivery services for process service during the month of May, $2050. Payment due by June 10.

- June 9, paid the amount due on May 31 invoice from lawyers Delivery service.

- Dec 31, Made a year ending adjusting entry to record depreciation expense on the firm’s library, $5100.

- Differentiate fixed and variable cost

- Tangible and intangible assets

- what is window dressing?

Past Paper 4 : Applied Accounting Guess Paper

University Name – Confidential

NOTE: Q.1 is compulsory, attempt any four questions from the remaining. All questions carry equal marks. Phones and other Electronic Gadgets are not allowed. Paper : Applied Accounting Time Allowed: 3 hours Examination: Final, Fall – 2020 Total Marks: 70, Passing Marks (35) Q.1Write short note on the following. a.What is accounting? b.Ratio analysis c.Intangible assets d.Difference between financial and management accounting. e.What is petty cash? Q.2 What according to you is the important of budget in any organization? Q.3 Assume you are given of financial statements of three different competitors. You are required to ascertain which of these three is in the best financial shape. What are the two main parameters that you will use to judge? Q.4 What does the cash flow statement about the company? Also give suggestions for improving the working capital flow of the company. Q.5. Libra pharmacy acquired a delivery truck at a cost of $ 14400. Estimated life of the truck is four years. Management of Libra pharmacy elects to use the straight line method of depreciation for vehicles.- state the amount of depreciation expense per year and per month. Give the adjusting entry to record depreciation on the truck at the end of first month and explain where the accounts involved would appear in financial statements.

- assume the delivery truck was acquired on September 1, 2001, and that this vehicle is only delivery truck owned by the business. Show how this truck would be reported in Libra Pharmacy’s balance sheet at December 31, 2001.

- compare the amount credited to Accumulated Depreciation in the adjusting entry in part a to the accumulated depreciation reported in the balance sheet at December 31, 2001 (part b). are these two amounts the same? Explain briefly.

- March 19, drafted a trust agreement for Patrick Stewart. Sent stewart an invoice for $1200 requesting payment within 30 days. ( the appropriate revenue account is entitled legal fees earned.)

- May 15, Owner Jean, Rodenberry withdraws $6000 from the business for personal use.

- May 31, received a bill from lawyers Delivery services for process service during the month of May, $2050. Payment due by June 10.

- June 9, paid the amount due on May 31 invoice from lawyers Delivery service.

- Dec 31, Made a year ending adjusting entry to record depreciation expense on the firm’s library, $5100.

- what is opportunity cost? b. What is the difference between inventory and cost of good sold?

- Explain current ratio in detail.