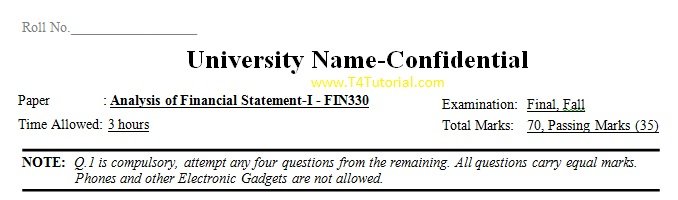

Analysis of Financial Statement Universities Past Papers

Q.1 Differentiate the following…

- a) Income statement / Balance sheet

- b) Long-term liabilities / fixed assets

- 2 Why companies require financial liability analysis? What is its impact on the balance sheet?

- 3 a) ABC company purchased a Machine on cash payment of Rs.12000 with an estimated life of 5 years and residual value Rs. 2000 on 1st July 2001. The machine was discarded on April 30th, 2003. Calculate and record depreciation expense for the years 2001, 2002 and 2003. ( The company used the straight-line method)

- b) On Jan 1, 2013, a merchant purchased Plant & Machinery costing Rs. 50000. It was decided to depreciate it @20 % p.a. show the plant and machinery account for the first three years under diminishing / double decline method.

Q .4 Discuss in detail different forms of the income statement and balance sheet with an example.

Q. 5 What are the effects of revaluation of assets on financial statements? Explain in detail.

Q.6. a) Sara & Majid started a partnership business on Jan, 1, 2014. Sara contributed Rs. 5000; Furniture valued Rs. 10000 & Majid brought Rs. 40000 in cash& Land worth Rs. 80000. Journalize the transaction and also record in balance sheet.

- b) A & B are partners in a business with capitals of Rs. 50000 & Rs. 30000 respectively. The net income earned for the year 2014 is Rs. 25000. Prepare journal entries under each of the following cases:

- If the profit sharing ratio is 3:2;

- If the profit sharing ratio is 70% to A & 30% to B;

- Up to Rs. 20000 in the ratio of 3:2 & remaining equally

- 8 Write short notes on any two of the followings

- The significance of financial statements in evaluating the health of the organization

- Components of trading & profit/ loss statement

- Purpose of common size analysis