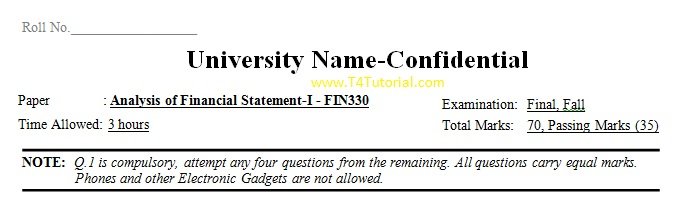

Analysis of Financial Statement Past Papers.

Paper 1: Financial Statement

Q.1 Differentiate the following…

- Fixed assets Vs. current assets

- Long-term liabilities vs. short-term liabilities

Q.2 Elaborate in detail the components of trading & profit/loss statement.

Q.3 How financial statement analysis contributes to maintaining the financial risk of a company.

- 4 The following information has been taken from the books of Mujeeb Corporations on December 31st,

2015.

Cash, $330000

A/R, 185000

Inventory 250000

Net fixed assets 765000

A/P, 229000

Accruals, 201000

Bank loan(short-term), 110000

Long-term debt, 300000

Common stock 90000

Retained earnings 499000.

Required: Calculate the following.

(i). Current ratio.

(ii). Debt to equity ratio

(iii). Quick ratio.

(iv). Working capital

- 5 On July 1st, 2014, Company A purchased equipment at the cost of $160,000. This equipment is estimated to have 5 year useful life. At the end of the 5th year, the salvage value (residual value) will be $20,000. Company A recognizes depreciation to the nearest whole month. Calculate the depreciation expenses for 2014, 2015 and 2016 using double declining balance depreciation method.

Q 6. Elaborate the concept of revaluation of assets in detail.

- 7 a) Sami & Sana started a partnership business on Jan 1, 2014. Sami contributed Rs. 5000; Furniture valued Rs. 10000 & Sana brought Rs. 40000 in cash& Land worth Rs. 80000. Journalize the transaction and also record in the balance sheet.

- b) A & B are partners in a business with capitals of Rs. 50000 & Rs. 30000 respectively. The net income earned for the year 2014 is Rs. 25000. Prepare journal entries under each of the following cases:

- If the profit sharing ratio is 3:2;

- If the profit sharing ratio is 70% to A & 30% to B;

- Up to Rs. 20000 in the ratio of 3:2 & remaining equally. 8 Write short notes on any two of the followings:

- Balance sheet

- Common size analysis

- Impact of liability analysis on balance sheet

Paper 2: Financial Statement

Q. 1 Differentiate the following…

a) Fixed assets Vs. current assets

b) Long term liabilities vs. short term liabilitiesQ.2 Elaborate in detail the components of trading & profit / loss statement.Q.3 How financial statement analysis contribute in maintaining the financial risk of a company.Q. 4 The following information has been taken from the books of Mujeeb Corporations on December 31st,

2015.

Cash, $330000

A/R, 185000

Inventory 250000

Net fixed assets 765000

A/P, 229000

Accruals, 201000

Bank loan(short term), 110000

Long term debt, 300000

Common stock 90000

Retained earnings 499000.

Required: Calculate the following.

(i). Current ratio.

(ii). Debt to equity ratio

(iii). Quick ratio.

(iv). Working capitalQ. 5 On July 1st, 2014, Company A purchased equipment at the cost of $160,000. This equipment is estimated to have 5 year useful life. At the end of the 5th year, the salvage value (residual value) will be $20,000. Company A recognizes depreciation to the nearest whole month. Calculate the depreciation expenses for 2014, 2015 and 2016 using double declining balance depreciation method.Q 6. Elaborate the concept of revaluation of assets in detail.Q. 7 a) Sami & Sana started a partnership business on Jan, 1, 2014. Sami contributed Rs. 5000; Furniture valued Rs. 10000 & Sana brought Rs. 40000 in cash& Land worth Rs. 80000. Journalize the transaction and also record in balance sheet.

b) A & B are partners in a business with capitals of Rs. 50000 & Rs. 30000 respectively. The net income earned for the year 2014 is Rs. 25000. Prepare journal entries under each of the following cases:

i. If the profit sharing ratio is 3:2;

ii. If the profit sharing ratio is 70% to A & 30% to B;

iii. Upto Rs. 20000 in the ratio of 3:2 & remaining equally.

Q. 8 Write short notes on any two of the followings:

a) Balance sheet

b) Common size analysis

c) Impact of liability analysis on balance sheet